Ethereum Price Prediction: $10K Narrative Gains Momentum as Technicals and Fundamentals Align

#ETH

- Technical Breakout: ETH price trading above key moving averages with bullish MACD convergence

- Institutional Catalyst: Record inflows and ETF speculation creating strong demand

- Ecosystem Momentum: NFT and DeFi developments supporting fundamental value

ETH Price Prediction

ETH Technical Analysis: Bullish Momentum Building

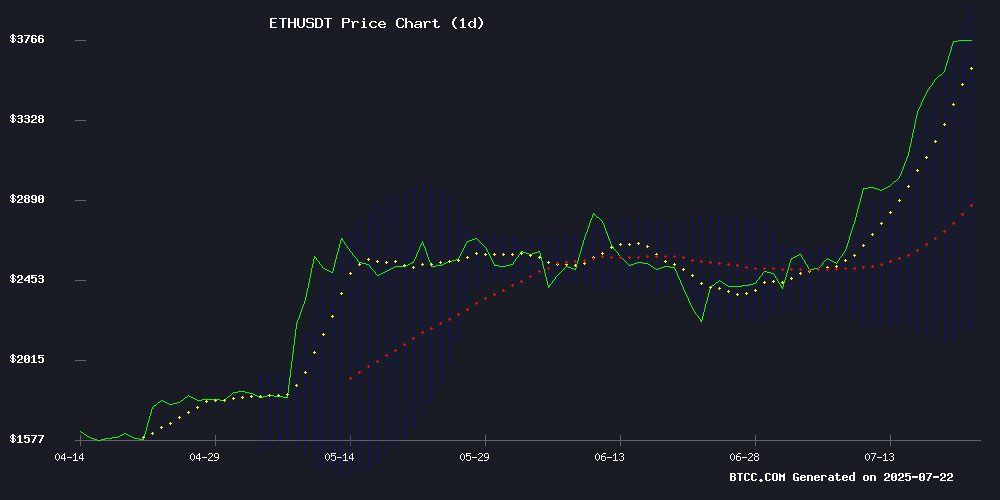

According to BTCC financial analyst Michael, Ethereum's current price of $3,765.44 shows strong bullish momentum, trading significantly above its 20-day moving average of $3,068.01. The MACD indicator remains negative but shows narrowing bearish divergence, suggesting weakening downward pressure. ethereum is currently testing the upper Bollinger Band at $3,954.34, which could act as immediate resistance. The widening gap between the price and moving average indicates strong buying interest.

Ethereum Market Sentiment: Institutional Demand Fuels Rally

BTCC analyst Michael notes that Ethereum's surge to 2025 highs is being driven by multiple bullish factors: institutional inflows, growing ETF interest, and positive developments in the ecosystem. Despite some negative news like the Tornado Cash legal issues and phishing scams, the overall sentiment remains overwhelmingly positive as Ethereum approaches the $4,000 level. The 'Ethereum Avengers' initiative and institutional demand are creating strong fundamental support for the rally.

Factors Influencing ETH's Price

Over $3.4 Billion in Ethereum Permanently Lost Due to Errors and Bugs

More than 913,111 ETH, valued at approximately $3.43 billion, has been irretrievably lost due to user mistakes and smart contract vulnerabilities. This represents over 0.76% of Ethereum's circulating supply, according to Coinbase director Conor Grogan.

The losses stem from high-profile incidents, including a 306,000 ETH loss by the Web3 Foundation from a Parity multisig wallet flaw and 60,000 ETH lost by defunct exchange QuadrigaCX. NFT project Akutars accidentally burned 11,500 ETH during a failed minting process, while users sent 25,000 ETH directly to burn addresses.

Grogan notes these figures are conservative, excluding potential losses from misplaced private keys or dormant Genesis wallets. The total impact grows significantly when considering ETH permanently removed via EIP-1559's burn mechanism.

Tornado Cash Developer's Legal Team Considers Mistrial Motion Amid Prosecution Gaps

Roman Storm's defense attorneys signaled potential legal turbulence in the Tornado Cash trial, suggesting they may seek a mistrial over perceived deficiencies in the U.S. government's case. The prosecution's failure to conclusively link the Ethereum mixing service to specific cybercrimes has created what defense counsel characterizes as critical evidentiary gaps.

Federal prosecutors countered that their argument against Storm—co-founder of the privacy-focused protocol that obscures transaction trails on Ethereum's blockchain—would crystallize in coming days. The development follows testimony from Hanfeng Lin, who claimed $250,000 losses in a cryptocurrency scheme, though the direct connection to Storm's platform remains contested.

Robinhood CEO Defends Tokenized OpenAI Stock Despite Controversy

Robinhood CEO Vlad Tenev has doubled down on the company's tokenized stock initiative, calling it a "big milestone" despite backlash from OpenAI. The unauthorized tokens, issued on Ethereum's Arbitrum network, tracked private company valuations without granting equity or voting rights—a move OpenAI swiftly condemned.

Tenev framed the controversy as an inevitable byproduct of innovation. The European airdrop highlights Robinhood's aggressive push into crypto-native financial products, even as regulatory gray areas persist. Tokenization of real-world assets continues gaining traction, with traditional finance and crypto increasingly colliding.

Defense in Roman Storm Trial Hints at Mistrial Over Tornado Cash Tracing Failure

Roman Storm's legal team raised the possibility of a mistrial on July 21 after FBI investigators failed to conclusively link stolen assets from the prosecution's first witness to the Tornado Cash cryptocurrency mixer. The defense argues that without verifiable on-chain evidence, testimony about funds passing through the privacy tool risks prejudicing the jury.

During proceedings, journalists observed Storm's attorneys conferring about potential mistrial motions after an FBI agent could not trace funds from victim Katie Lin through Tornado Cash. Lin had previously testified about losing her life savings to a pig-butchering scam allegedly laundered through the mixer co-created by Storm.

Prosecutors maintain a second tracing expert will address the transfer pathway later in the trial, though the format of this testimony remains unclear. The evidentiary challenge comes as independent research questions the government's technical assertions about Tornado Cash's functionality.

Ethereum Surges to $3,764 as Institutional Inflows Drive Momentum

Ether climbed 0.57% to $3,764.99, extending its bullish momentum as Wall Street's appetite for crypto exposure grows. BlackRock's iShares Ethereum ETF recorded $180.27 million in inflows—one of the largest single-day accumulations since ETH ETFs launched.

The rally comes amid extreme overbought conditions, with Ethereum's RSI hitting 87.50. Such levels typically precede corrections, though regulatory progress may cushion any pullback. The U.S. House passed the GENIUS Act on July 17, providing clarity on stablecoins and expanding the CFTC's crypto oversight—a long-awaited development for institutional investors.

Pudgy Penguins CEO Foresees NFT Revival and Crypto Gaming Surge

Luca Netz, CEO of Pudgy Penguins and co-inventor of Ethereum L2 Abstract, predicts a resurgence of NFT mania akin to the 2020-2021 bull cycle. "I think you’ll see a version of 2020, 2021, happen again," Netz stated in an interview, emphasizing his bullish stance on digital collectibles.

Gaming emerges as an even stronger conviction for Netz. "I’m even more certain about gaming than I am NFTs," he remarked, signaling potential for blockchain gaming to outperform other crypto verticals. The Penguins’ expansion into plush toys, children’s books, and meme-based content reflects a strategic pivot toward becoming a cross-generational IP challenger to established franchises like Pokémon.

Ethereum Surges Past $3,800, Igniting Altcoin Rally and Liquidating $100M in Shorts

Ethereum's explosive rally above $3,800 has reshaped the crypto landscape, liquidating over $100 million in bearish bets within 24 hours. The second-largest cryptocurrency now eyes the $4,000 threshold after a 70% monthly gain—its strongest performance this year.

Altcoins are riding Ethereum's coattails as institutional capital flows into the ecosystem. SharpLink's $6 billion deployment signals growing confidence in ETH's infrastructure, while technical indicators suggest sustained momentum. Market dynamics are shifting as ETH outperforms Bitcoin, potentially heralding a new altcoin season.

The violent short squeeze underscores the risks of counter-trend positioning in volatile crypto markets. Traders now watch whether this breakout can sustain above key psychological levels, with the entire altcoin complex benefiting from ETH's leadership.

Ethereum Hits 2025 High Amid Institutional Demand and ETF Interest

Ethereum surged to a 2025 peak of $3,848 on Monday, marking a 26% weekly gain as institutional adoption accelerates. The rally coincides with growing corporate treasury allocations to ETH and robust inflows into U.S.-listed Ethereum ETFs.

Despite the uptrend, ETH remains 22% below its 2021 all-time high of $4,878—a threshold Bitcoin has already shattered in its current bull run. Open interest in Ethereum derivatives reached $56 billion, reflecting heightened trader speculation about future price movements.

The second-largest cryptocurrency last traded at these levels in December 2024. Its sustained momentum suggests a broadening market recovery beyond Bitcoin's dominance, though ETH still trails its predecessor's record-breaking performance this cycle.

Ethereum’s $10K Narrative Gains Momentum as July Rally Nears $4,000

Ethereum’s price surge continues to captivate the market, with a 51% gain in July 2025 pushing it to $3,768.63—a seven-month high. The rally is fueled by institutional demand, declining exchange balances, and optimism around spot ETH ETFs. Over 317,000 ETH ($1.18B) exited exchanges this month, signaling strong accumulation.

Two institutional wallets acquired 58,268 ETH ($212M), reinforcing bullish sentiment. Analysts highlight a multi-year ascending triangle pattern, with a breakout above $4,000 potentially paving the way for a $10K target. "The aggressive accumulation trend reflects expectations of further upside," says analyst Aaryamann Shrivastava.

DeFi User Loses $1.2M in Uniswap Phishing Scam via Google Ads

A decentralized finance (DeFi) investor suffered a $1.23 million loss after interacting with a fraudulent Uniswap clone promoted through Google Ads. The phishing site exploited transaction signatures to drain the victim’s Uniswap V3 NFT positions, bypassing private key requirements.

Scam Sniffer’s alert highlights the proliferation of Punycode-based spoof domains mimicking legitimate platforms. These attacks leverage Cyrillic characters to create visually identical URLs, with malicious smart contracts executing blanket transfer approvals upon signature.

The incident underscores growing security challenges in Web3 adoption, particularly around ad platform accountability. Major exchanges and DeFi protocols face mounting pressure to implement enhanced domain verification and transaction simulation tools.

'Ethereum Avengers' Firm to Generate ETH Using $1.5 Billion Stockpile

The Ether Machine, a new entity formed through a business combination between The Ether Reserve and Dynamix Corporation, is set to debut on Nasdaq with a staggering $1.5 billion Ethereum stockpile. Holding 400,000 ETH—potentially the largest position in any Strategic Ethereum Reserve—the company plans to amplify its holdings through staking and DeFi strategies.

Dynamix Corporation's shares surged 36% to $14.20 following the announcement. Post-deal completion, The Ether Machine will trade under the ticker 'ETHM.' Anchor investor Andrew Keys, former Consensys executive, contributed 170,000 ETH ($645 million), while $800 million was raised with participation from crypto exchanges.

How High Will ETH Price Go?

Based on current technicals and market sentiment, BTCC's Michael projects Ethereum could test $4,200-$4,500 in the near term. Key factors supporting this prediction include:

| Factor | Impact |

|---|---|

| Technical Breakout | Price above key moving averages with MACD showing bullish convergence |

| Institutional Demand | Record inflows into ETH products and growing ETF interest |

| Market Sentiment | Overwhelmingly bullish with $10K narrative gaining traction |

| Ecosystem Growth | NFT revival and DeFi developments supporting fundamentals |

The $4,000 level appears to be the next psychological barrier, with potential for extended rally if broken convincingly.

html